Key Concepts in Bookkeeping 8443472955

Bookkeeping is a fundamental aspect of financial management that hinges on several key concepts. Understanding debits and credits is essential for accurate record-keeping. Journals and ledgers serve as vital tools for organizing transactions. Additionally, the reconciliation process is critical for identifying discrepancies. Financial statements offer insights into a business’s health, influencing strategic decisions. Exploring these elements reveals how they interconnect, shaping effective financial practices and organizational autonomy.

Understanding Debits and Credits

A fundamental concept in bookkeeping is the relationship between debits and credits, which underpin the double-entry accounting system.

Debit definitions indicate an increase in assets or expenses, while credit applications reflect an increase in liabilities or revenue.

This balance ensures financial accuracy, empowering individuals to manage their finances effectively, maintaining autonomy in their financial decisions and fostering a deeper understanding of their economic environment.

The Importance of Journals and Ledgers

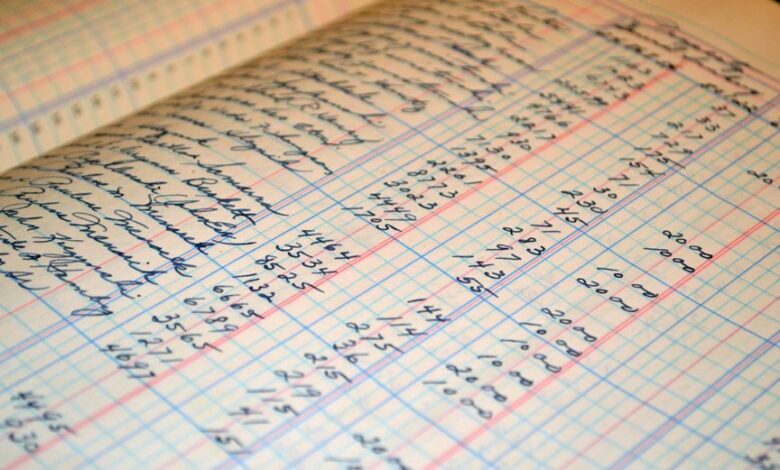

While many aspects of bookkeeping contribute to financial management, the roles of journals and ledgers stand out as essential components of the accounting process.

Journal entries systematically record financial transactions, providing a chronological account, while ledger organization aggregates these entries into specific accounts for analysis.

This structured approach ensures accuracy and clarity, empowering individuals to maintain financial freedom through informed decision-making.

Mastering the Art of Reconciliation

Reconciliation serves as a critical process in bookkeeping, ensuring that financial records are accurate and consistent across various accounts.

Employing effective reconciliation techniques allows for the identification of discrepancies, facilitating timely error correction.

This meticulous approach not only enhances financial integrity but also empowers businesses to maintain clarity in their financial statements, ultimately fostering a sense of freedom in financial decision-making.

Financial Statements and Their Significance

Financial statements play an indispensable role in the management and assessment of a business’s economic health. They provide critical insights through financial ratios that evaluate profitability, liquidity, and solvency.

Additionally, cash flow statements highlight the inflow and outflow of funds, ensuring that stakeholders understand operational efficiency.

Collectively, these documents empower informed decision-making, fostering transparency and enabling strategic planning for sustainable growth.

Conclusion

In conclusion, mastering key concepts in bookkeeping is akin to learning the intricate dance of a well-orchestrated symphony. Just as musicians rely on each note to create harmony, businesses depend on the precise interplay of debits, credits, journals, ledgers, and reconciliations to achieve financial clarity. By understanding these fundamental elements, organizations can navigate the complexities of their financial landscapes, ensuring they remain in tune with their economic health and poised for strategic growth.